Or what’s going to feel like a double-dip anyway.

Don’t read too much into that. I’m not making a prediction. But there are plenty of people who are. Nouriel Roubini, that guy who just happened to predict the first financial collapse, says it’s likely we’ll have a double dip, in which GDP drops again after going up for a time, or at least a long, slow recovery.

Plenty of other economists disagree. But as I’ve mentioned before, what’s going to matter to you is not what happens to the economy at large but what happens in your personal economy. If you lose your job, the recession was terrible. If you didn’t, it wasn’t so bad. Yeah, it’s a sad, selfish demarcation line. But I bet it’s the truth.

However, it is becoming clear that even if there’s no double-dip, the unemployment rate is going to be staying very high for a long time. And no one is predicting a strong, sustained rebound in the stock market either. You’re still vulnerable to a crummy economy’s effects even if you’ve made it this far unscathed. Here’s how to prepare for the long slog to recovery.

1. Keep your emergency fund high.

Hopefully, you’ve been socking away cash in a money market account or money market fund, just in case unemployment strikes. When the economy started to add jobs again, it was probably tempting to cut that one-year emergency fund back to six months. Big mistake.

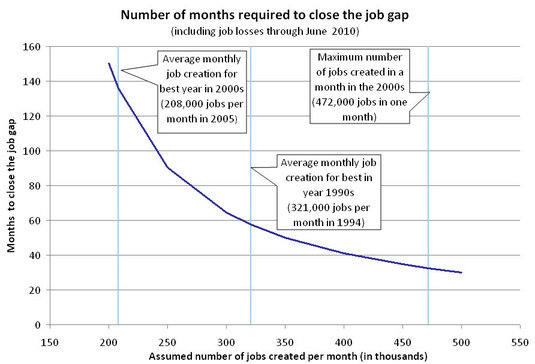

For one, let’s put the job “growth” in perspective. In June, the economy lost 125,000 jobs, not counting seasonal farm workers. The unemployment rate did edge down to 9.5%, but that was due to thousands of workers giving up—not because they were finding jobs. Take a look at this chart, via Ezra Klein and the Brookings Institution. The “job gap” is how many jobs it would take to return to the employment level before the recession started.

In what Brookings calls a “more optimistic” scenario, it takes five years to get back to where we were. In other words, losing a job is going to remain unusually likely and unusually painful for a very long time.

Another thing to be wary of: Congress is suspicious of unemployment benefits. For the last few weeks, the Senate refused to extend benefits, dropping the maximum 99 weeks you could collect down to 26. It looks like they’re going to extend them at least until November. But next time, its passage will be even tougher. So, you would be well advised to keep that emergency fund high or even build it up further if you can.

2. Shed unnecessary contracts and expenses.

Contracts are the enemy of a crisis. Two-year cell phone agreements, DSL and satellite television contracts, adjustable-rate mortgages, you name it. Anything that locks in a monthly payment should be shunned like the plague.

I recently wrote that I could move into a cheaper apartment if I needed to cut my expenses. Well, actually that’s not true. Not for another 12 months at least. In fact, cable TV, which in my case came with no contract, was a relatively innocuous expense. If you do lose your job, you don’t want to be in a situation with high fixed expenses, which can’t be downshifted if you’re in trouble. Flexibility is your friend.

How do you cope if you’re already locked in? Well, don’t sign up again—that’s a given. Rather than giving into the temptation to upgrade your phone and lock in another two-year contract, stick with your old one as long as you can and stay month-to-month. Choose cable TV over satellite—you probably can’t get satellite TV for much cheaper anyway.

And in the case of a lease, check your local tenant laws to see what happens if you have to break it. Some states make it very difficult for a landlord to pursue a tenant who gives notice and leaves. And an understanding landlord would rather have you pay what you can and get out than face a tenant who can’t pay and plans to squat through a long eviction process.

3. Become the most important person at work.

You don’t have to literally be the guy who has all the passwords to have all the power. A knee-jerk reaction to turbulence at work is to put your head down and hope you avoid the axe. What you should really do is be visible. Be the one who offers business-growing suggestions at meetings or in a quick e-mail to the boss.

Exceed your sales targets if your a salesman. Finish the project early if you’re a coder. If your company has to cut costs, they will spare the workers who gave them measurable, revenue-generating achievements, not the ones who simply stayed from 9 to 7 instead of from 9 to 5. Coincidentally, if your company doesn’t fire anybody, measurable achievements that you can bring up at review time are also likely to get you a raise.

4. Network now.

There’s not a worse feeling than losing your job and not knowing where to go. I’ve spoken to dozens of people who hadn’t maintained their professional networks other than with a LinkedIn or Facebook account before getting their walking papers. (I am running out of cliched synonyms for “getting fired.” Sorry.)

It’s a sad fact that making connections and getting a new job are much easier when you already have one. So take advantage of that, um, advantage by attending networking events and setting up lunches or coffees with mentors, both outside your company and within it. I once had a boss whose wife asked him every Friday what he had done that week to prepare for his next job. Awesome wife.

5. Invest with caution.

One of the mantras I used to write, but now cringe at, is this: “Buy more stocks when the market crashes. They’re on sale!” That’s about as much of a truism as it is that your local Lexus dealer put a car “on sale” by slashing its price to $35,000 from $40,000. Still seems pretty overpriced to me.

This isn’t a point about market-timing, just about us, “good” investors’ natural tendency to take contrarianism to an unhealthy extreme. Yeah, stocks are a better deal than they were in 2007, but that doesn’t make them such a good deal that you should make an outsized bet on their performance now. Don’t try to make up for losses by taking extra risk with your retirement money.

But I’m actually more concerned right now with people taking extra risk with their short-term savings. Savings rates are abysmal right now. My Vanguard money market fund is paying 0.11%. Money market accounts are paying better, but not by much. This brings the temptation to “chase yield”—by putting money in higher yield, but higher risk investments.

Truth be told, I would be O.K. with my money market funds and money market accounts paying 0% interest—though that would mean I was lazy about finding a better option. My emergency fund is about liquidity and having the money when I need it, not about what that money earns. Peace of mind is its own form of interest.

So good luck out there. The recession is no doubt over, but your personal economy—or, dare I say, your pop economy—is still at risk.

Be sure to check out this week’s Carnival of Personal Finance at NerdWallet. Your’s truly was an editor’s pick.

{ 7 comments… read them below or add one }

Savings rates are abysmal right now. My Vanguard money market fund is paying 0.11%.

One of the problems with economic bad times is that people get caught up in gloom and doom. That makes things worse. I believe strongly that the best way to help is to put a positive spin on things when this can be done honestly. This is one of those cases, in my assessment.

Stocks are in all likelihood headed to a valuation level of one-half fair value (that’s where they ended up following every earlier trip to insanely high valuations). At one-half fair value, the most likely 10-year return is 15 percent real. That’s amazing. Every dollar that you today put in a fund paying 0.11 is going to be paying 15 percent real in a few years. Your combined return is not going to be anything even remotely in the neighborhood of 0.11. It’s going to be something like 14 percent real.

These are not bad times for investors. These are bad times for investors who do not take valuations into consideration. But my view is that all times are bad times for investors who do not take valuations into consideration (it’s just that some of us are at times fooled by temporary gains into thinking that not paying attention to valuations can work).

Rob

Good point about networking. We always need to keep those contacts fresh. Keeping that EF beefed up is a must. I think stocks are on sale but you need to keep at least 25% of portfolio in low risk investments. This will be a slow rebound for sure.

I read an intersting article in Yahoo Finance today about the disappearing middle class. Not only is it going to take years before the unemployment rate returns to normal, some jobs will be lost forever. If you work in any type of job that could be outsourced or moved overseas, you need to seriously consider alternatives. Those jobs aren’t coming back.

In April, just 3 months ago, this site had a post on the topic of emergency funds.

Pop, you called them “giant slush funds” and “sumo funds.” You advocated reducing them. I find it interesting that you have removed this post, and all the comments associated with them as well.

In my comment to this post I spoke in favor of increasing our emergency funds, not reducing them. I wrote, “We are all now living in times of great uncertainty. During times of uncertainty, the likelihood of becoming a victim of unforeseen circumstance increases.”

On July 21 Mr Bernanke told the Senate Banking committee that the US economy faces “unusual uncertainty.â€

In my comment on the now vanished post I also said, “In our current environment it seems foolish to advocate reducing an emergency fund. It seems to me that prudence in uncertain times of protracted high unemployment would dictate setting aside a bigger emergency fund, not a smaller one.”

And in this post, just 3 months after you encouraged us to reduce our emergency funds, you now say, “Keep your emergency fund high. Hopefully, you’be been socking away cash in a money market account or money market fund, just in case unemployment strikes. When the economy started to add jobs again, it was probably tempting to cut that one-year emergency fund back to six months. Big mistake.” What you advocated 3 months ago is now a big mistake, and my recommendation has risen to the forefront.

Coincidence? Or is it possible that you and Mr. Bernanke are channeling me?

The mind boggles!

I haven’t removed that post…it actually went up in January and is here: http://www.popeconomics.com/2010/01/22/sumo-sized-emergency-funds-are-they-necessary/

In any case, I think joint emergency funds can still allow you to keep the level lower than normal. The chances of you and other family members losing your job at the same time seems low enough that one fund could share responsibility for several people. That said, when I talk about emergency funds as one point within a larger post, it would be a little cumbersome to describe that kind of system every time. So when that happens, you can assume I’m talking about one person with his own fund.

Ooops..sorry Pop, my bad!

Don’t get me wrong – I am really glad that you are recommending a big emergency fund. But if someone had read your advice in January and reduced their emergency fund, just one job loss, sickness, death, or other unforeseen circumstance would have had an even more negative impact on them and their extended family.

In one family I know, both parents are at the end of their unemployment benefits. Their high school age son is the only one in the family generating any income. One of the grandparents is making their house payment. Even with food stamps, once their benefits run out they won’t be able to afford to eat and they’ll have to move in with relatives.

Their car died and needed repairs they could not afford. The only reason they have transportation is because the owner of the shop where they took their car for repairs felt sorry for them and gave them an old van that another customer had abandoned – he could not pay for the repairs owed on it.

I know people who have had to pull their kids out of private school. I know people whose children will not be able to graduate from college because they can’t afford to return to college in the fall. They are reluctant to get any job at all because if they do they have to begin paying back their student loans.

In some cases, people have lost everything they have. One family went from a mid six figure income and a large home to living in a friend’s basement. They have exhausted their severance, emergency fund, investments, and retirement accounts. Both parents have been without jobs for over 2 years and as of yesterday they had only $200 in their checking account.

All of these families had more than a year’s with of expenses socked away – some had 2 year’s worth. I could tell you many, many more stories of friends and acquaintances who are dealing with the worst times they have ever faced.

One out of every 2 working age Americans has no job. Families are hurting. The value of what they have set aside to get thru troubled times is now threatened with being inflated away as our Treasury Department continues to float more and more debt – debt we will never be able to repay.

In the words of Uncle Ben of “Spiderman” – “With great power comes great responsibility.” Your words have power. Please use them wisely. Please use them to help – not harm.

Economists don’t predict a double-dip recession because economies don’t behave that way (absent policy errors).

People want to work. Companies want to make and sell things. People want to buy things. And everybody wants to do more of all of it. The population is also growing, which should add 100,000 jobs a month to the economy.

But the key is, “absent policy errors.” And there are plenty of those. Still, it would take mismanagement on a massive scale to actually drive the economy South, and to forestall a recovery.

{ 1 trackback }