Plane crashes are not that common. And yet…

You’ve probably heard the old yarn about how we often overestimate the chances of dying in a plane crash. When I made a guess before beginning this post, I was actually off by a factor of ten. I, somewhat flippantly, guessed one in a million, when really the chances are closer to one in 11 million.

The mistake (too conveniently) illustrates the point of this post. Humans are notoriously bad at knowing how risky things are, which leads to all sorts of bad decisions we make with our money.

First, it’s important to talk about, um, why this is important. You see, most of the time when we talk about risk, we distinguish people by whether or not they have “risky” or “safe” attitudes. So, men, for example, tend to be more cavalier than women with putting a large amount into stocks, with the idea that they’re more willing to gamble for a big gain.

But a failure in risk perception breaks that model. It could be that men just don’t properly comprehend the risks associated with undertaking an endeavor. So, for example, a man could simply not know the risks in investing a certain allocation in stocks, rather than be more tolerant of them.

But before we get into that, let’s see how good you are at ranking certain non-financial risks.

What scares you the most?

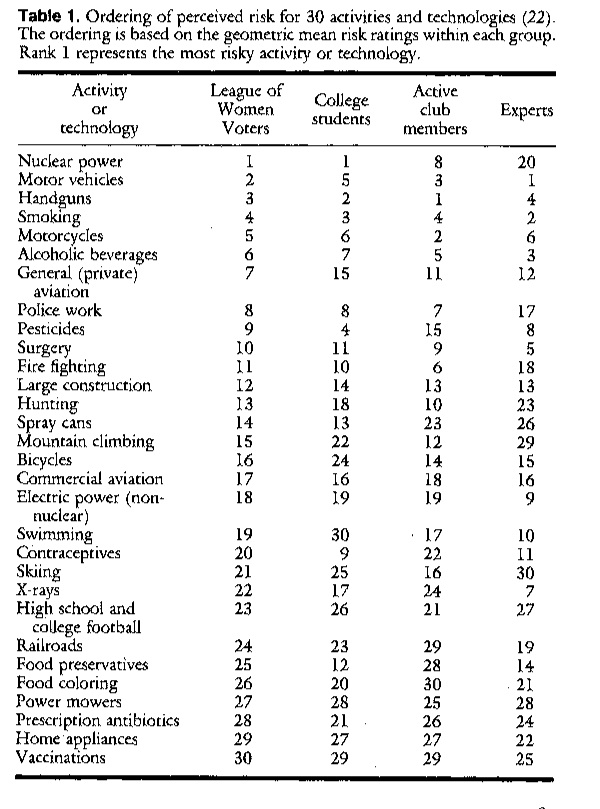

A couple decades ago, Paul Slovic, founder of Decision Research, and a couple other academics asked a few groups of people in Oregon to rank the “present risk of death” of 30 activities. The researchers then asked risk assessment experts to guess the risk. Later, the researchers found that experts’ guesses were extremely close to actual fatality risk, so we’ll just use them as a proxy for the truth.

Anyway, here’s how the ranking of perceived and actual risk ended up:

As you can see from the chart, with some kinds of events, the laypeople were spot on. Car accidents, indeed, are a leading cause of death, and the League of Women voters, college students, and the Active Club all accurately put that at least in the top five of death risk.

But some predictions on risk, were laughably off. Most notably, the League, students, and club all put “nuclear power” at least within the top 10 of death risk, when the risk was actually very low. You’d probably not put nuclear power very high up on the list yourself, but these surveys were conducted in the late 1970s, back when nuclear power was more closely associated with mushroom clouds than green energy. Though I think it’s worth noting, that the surveys would have been pre-Chernobyl.

The worst part: We’re really confident about perceived risk.

What are more common, homicides or suicides? Now, what odds would you put on your being correct?

A few researchers did this a couple years ago and found a large percentage thought homicides happened more frequently than suicides, apparently based on homicides’ prevalence in newspapers. Suicides happen much more frequently.

But more interesting, when asked to place odds on how sure they were in their answer, more than 30% gave their guess odds of 50 to 1 or greater. In other words, not only were they wrong, they were really sure in their wrong answer.

It doesn’t help when you’re an expert. Researchers asked seven, internationally known geotechnical engineers to set upper and lower bounds for at what height a clay embankment would collapse. They were supposed to be 50% certain that the actual height would be in the range. None of them picked a range that included the actual fail point. (Again, via Slovic.)

So not only are we bad at calculating risks, we’re really confident in ourselves despite that. Hopefully, if the test subjects were asked to put money on the bet, they’d be a little less cavalier. But in determining our stock allocation, we’re basically asked to estimate and wager on risks all the time.

The difference between improbable and impossible

The most common mistake I see in personal finance is confusing unlikely with impossible. It’s unlikely that stocks will fall or rise by an extreme amount on any given day, but it does happen. Consider this passage from a Forbes article last year:

A prime example: Oct. 19, 1987, when the S&P 500 fell 20% in a single day. The average move up or down over the past half century is 0.65%. By that measure, Black Monday was what is referred to as a 25-sigma event, meaning it was 25 standard deviations away from the mean. If you were to plot a normal statistical distribution, a 25-sigma event would happen … well … never. It would be less likely than winning the Powerball a trillion times a day every day for a trillion trillion trillion lifetimes.

Even ignoring Black Monday, if returns were “normal,” statisticians would expect the S&P 500 to move up or down by 3.5% or more only once every 10,000 years.

So, given what’s “likely” in any given time period, you’re likely to never see the S&P 500 move up or down by 3.5% or more in your lifetime. In actuality, that’s happened more than 100 times in the last 60 years.

And even though your chances of a loss in stocks gets smaller the longer you hold them, the possible loss gets greater. As said by Boston University professor Zvi Bodie (whom I embarrassingly mischaracterized earlier this year): “For example, say you have $500,000 and are three years away from retirement. If you suffer three years of 15% losses, your savings will be almost cut in half — and your retirement will be jeopardized. Of course, the longer the string of losses continues, the larger the shortfall will be.”

You can debate whether returns are related to each other in that way (i.e. does the chance of stocks dropping 15% go lower if they dropped 15% the previous year?), but all it takes is a year like 2009 or 2002 to recognize that extreme stock market events, while unlikely, can have dramatic impacts on your savings.

Another risk we’re probably not planning enough for: longevity risk. How many times have you put your “expected death” at 85-years-old in a retirement calculator? According to the Social Security actuarial tables, if a man is aged 85, he’s likely to live another 5 years if he’s already made it that far. (That’s not the same as a life expectancy at birth, which the SSA pegs at 75.)

Or how about our propensity to buy life insurance, but not to buy disability insurance? You’re probably more afraid of dying than of getting an injury or disease that prevents you from working, but according to the Health Insurance Association of America (admittedly an angle here…), about a third of us will get some sort of illness between the ages of 35 and 65 that prevents us from working for more than 90 days.

To make a long story short, don’t give short shrift to catastrophic unlikelihoods. And next time you’re sure of your chances on a bet, for God’s sakes, look it up.

This post was featured in the Carnival of Personal Finance at Simply Forties. Check it out!

{ 1022 comments… read them below or add one }

← Previous Comments

This post is overflowing with high-energy brilliance!

I can feel your excitement through the screen — awesome!

This was such a fun and energetic ride — loved it!

Your content is consistently insightful and inspiring.

This was such an enlightening read — thank you for sharing your expertise!

You’ve injected so much enthusiasm into this — amazing!

This was such a fun and energetic ride — loved it!

You always leave readers better informed — thank you!

Your dedication to quality really shows here.

You have such an authentic and compelling voice.

Your vibrant approach is absolutely refreshing — great work!

Amazing job — I’ll be sharing this with others.

Your ability to explain things simply is such a gift.

Your writing brings so much clarity and value.

You’ve taken this topic to a whole new level — amazing!

This content POPS — amazing job!

I can’t get over how enthusiastic and uplifting this is — WOW!

What a refreshing perspective — I really enjoyed reading this.

Your insights are always so refreshing.

I appreciate how engaging and informative this was.

I’m blown away by the value in this post.

I gained so much clarity from this article.

← Previous Comments

{ 1 trackback }