Both anecdotes and statistics lie.

Earlier this month, the Wall Street Journal and Sarah Palin had a rare face-off over a pretty trivial remark. In a blog post, a reporter wrote about a speech Palin gave against the Fed’s new quantitative easing efforts, and toward the end, pointed out that one bit of rhetoric she gave—“everyone who ever goes out shopping for groceries knows that prices have risen significantly over the past year or so. Pump priming would push them even higher.‗contrasted with the Bureau of Labor Statistics’ official measures of inflation.

Palin (or a representative) responded on her Facebook page, and the reporter responded to that response, and quickly thousands of commenters were chiming in with their own views on whether or not grocery prices had or hadn’t risen in the last year or so.

Anyway, according to the BLS, inflation has been remarkably low. In October, prices rose 0.2% compared to September (including food and energy), the smallest increase the bureau has ever tracked. When you subtract food and energy prices (which tend to be volatile), prices didn’t change at all and were only 0.6% higher than a year ago.

But here’s a shocker that underscores the WSJ/Palin debate, when you have bills to pay every month, you don’t really care what the Labor Dept. says. You care about whether or not your bills have risen. And you make an assumption about how other people’s bills must have changed based on your own experience.

We believe that what we can remember is common.

It’s called the “availability heuristic”. If you can remember more instances of something happening, you’re more likely to believe that whatever that occurrence demonstrates is common.

Daniel Kahnemann and Amos Tversky demonstrated this tendency in the ’70s, asking test subjects to listen to a list of names and afterwards estimate how many men and women were on the list. Some of the lists contained names of famous women but less-famous men. On other lists, the men named were more famous. The test was hard…in reality there was always either one extra man or one extra woman.

One group was asked to simply recall as many names as they could. On average, the 99 people who took the test recalled 42% of the less-famous names and 65% of the more-famous ones.

The other group was asked to estimate if there were more men or women on the list. Of the 99 test subjects, 80 erroneously picked the gender that had more famous names

So in other words, because the testers could remember more of the famous people than the not-so-famous people, they thought more of them must have been on the list.

We remember the negative better than the positive.

How could that translate to this inflation debate? I don’t know about you, but I remember times when I felt like I got ripped off much better than times when I felt like I scored a deal.

I can distinctly remember the last time I paid $7 for a small carton of strawberries, for example. It made me mad. I mean, it’s just fruit! Are you kidding me? Predictably, it happened when the strawberries were out of season, but for a while, it gave me the erroneous impression that strawberries were always that expensive. It took an entire summer of $4 cartons of strawberries before I realized that I wasn’t just getting lucky by finding them “on sale”.

And lest I fall into my own trap of relying on an anecdote to prove a trend, the ability of negative emotion to enhance memory has been well-studied. Boston College’s Elizabeth Kensinger asked volunteers to view “negative” images next to neutral backgrounds—such as a snake by a river—or “neutral” images against to neutral backgrounds—such as a monkey by a forest—and found that people were more prone to remember the neutral background when the primary images were negative.

So if we remember the bad stuff but let memories of the good stuff slip away, could it be that the Labor Dept. isn’t “lying” about inflation, and that prices really might not have moved up that much?

“Anecdotes” on inflation from Mint.com

Lucky for us, the BLS isn’t the only source of price changes anymore. Mint.com, which allows users to aggregate all of their financial accounts in one place, recently began to offer some of their aggregated data to the general public. So now, for example, you can see what the average receipts were for a Publix in Ft. Lauderdale or a Safeway in Seattle.

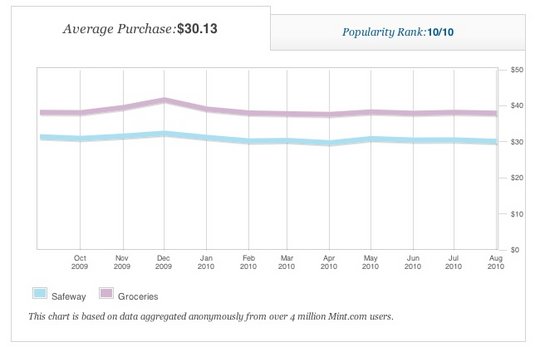

It turns out that prices haven’t risen much based on that data either. Check out the following graph of purchases at Safeway in Seattle:

At this particular Safeway, grocery purchases have stayed at about $30 for the last 12 months.

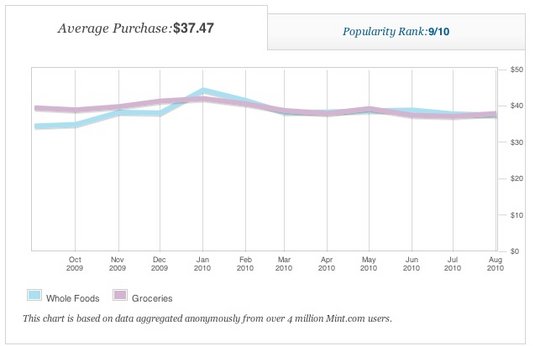

Here’s a Whole Foods in Ann Arbor:

Prices have stayed right around $40 and might have even dipped a tiny bit.

Of course, maybe people are buying less food to keep the prices low, as in the case of the shrinking sizes of products that many people have noticed. So maybe people are making more trips to the grocery store, even though individual trips cost the same.

As I churn through these charts, I’m finding a lot of little anecdotes that seem to support the BLS’s conclusions.

The real debate about the Federal Reserve’s quantitative easing methods right now are about whether they’ll cause inflation in the future, which economists are very divided on. But before you get mad and point out that the inflation is already happening, check your bills! I wonder if you (and me, for that matter) are just remembering the rip-offs without remembering the steals.

{ 3 comments… read them below or add one }

That’s interesting that we only remember the negatives but not the positives in short-term situations.

Yet long-term things like the Depression and frugality haven’t stuck through the generations as a reminder of how bad it can/could/did get when people don’t save and don’t look out for their futures.

Mint.com’s famous “Phase II” is fun and useful, isn’t it?

Cool use of Mint.

My groceries are stable right now. We are eating less. We eat much less processed foods. Our grocery bill fluctuates only a few dollars from month to month—unless our children come to stay. In that case inflation hits us like a ton of bricks!

Currently I see neither inflation nor deflation. Good thing- since my husband’s retirement pay will not go up for the second year in a row.

What I do see is younger people making WAY more money than we did four years ago. I am on the sideline, “save, save, save”. I think it is coming- soon!