Oscar Wilde died broke, why not you?

Ok, bad example. Wilde was an extremely gifted poet and playwright, but he had a lot of personal problems confounding him before his death. This post is about a question that’s a little more clear cut than that: Does being smart make you better with money?

Yeah, it’s wide-ranging, and you think you might know the answer off the top of your head. My automatic answer was, “Yes! Of course.” Smart people are better at math, which would make them see through to the consequences of their decisions more clearly, right?

I dug up an old Yahoo! Answers user who posited the same question. The winning answer had a bunch of mumbo jumbo about common sense versus book smarts and something called a “social IQ.” So the Web 1.0 unscientific survey of anonymous web users named “species456″, “Father Christmas”, and “Ratz” says intelligence and money aren’t correlated at all.

I was hoping to find the definitive economic analysis that would allow Pop to smack Ratz back to the, um, sewer, but (sigh), things are never that clear cut. So without further ado, let’s get to how smarts affect wealth.

Smart people take more risks but show more patience.

I recently tripped upon a paper published last year by several German economists who studied whether someone’s IQ plays a factor in how likely they are to take risks or show patience when presented with financial problems. It turns out that it does, even when you control for things like age, experience, and wealth.

First, the thousand or so participants were asked to take different modules of the Wechsler Adult Intelligence Scale test, one of the most popular tests to measure someone’s intelligence quotient (IQ). They also filled out a separate survey with demographic data: age, income, race, etc.

Next, the economists asked participants to participate in one of two paid experiments designed to measure risk aversion or impatience.

The risk aversion test took the form of a lottery. You could either take a guaranteed, safe payment or choose to participate in a lottery where you had a 50% chance of winning 300 Euros (you won nothing if you lost). The tester would “tempt” the subject with a safe payment of 0 Euros to start (I’d guess everyone would pick the lottery at that point), then with 10 Euros, then 20 Euros, and all the way up until someone could pick a safe payment of 190 Euros rather than take the risk. A completely rational person would take the bet until the safe offer hit 150 Euros (50% of 300).

For the patience test, economists told the subjects that they could either have 100 Euros now or a larger amount of Euros a year later. In a similar fashion to the risk aversion test, they tempted people with increasingly larger amounts until the subject said he’d take the delayed payment.

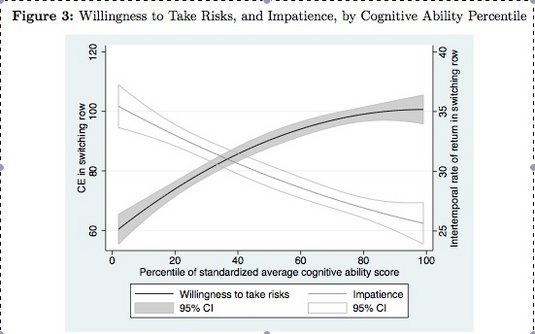

Anyway, to cut to the chase, here’s the graph of their results:

And in case you have trouble reading that (who wouldn’t?), the gray-enclosed line shows how risk-taking changes with increased intelligence and the white-enclosed line shows how impatience changes as people get smarter. It looks like smart people are both more willing to take risks and more willing to wait for a payout.

Smart people make more money, but aren’t necessarily more wealthy.

If I were to pick a favorite data set amongst all the data that the Bureau of Labor Statistics collects (and everyone does this, right?), it would, without a doubt, be the National Longitudinal Survey of Youth. The BLS has been following about 7,400 Americans who were born between 1957 and 1964 for nearly three decades (they started the surveys in 1979), asking them about their work histories, incomes, life events, and all that other fun stuff economists love to analyze. What makes it unique is its long-term look. They spoke to Joe Smith when he was 17, and caught up with him again each year until 1994. Now they only talk to Joe every couple years, but still, that’s a lot of data on one guy that you can harvest for all sorts of interesting experiments.

Well, a research scientist from Ohio State University named Jay Zagorsky decided to mine the data to see how well intelligence predicted how much money people ended up making and how wealthy they were.

Instead of an I.Q. test, the subjects took the Armed Forces Qualification Test, which the Department of Defense uses to judge the mental acuity of new recruits. Then, Zagorsky surveyed them on their incomes, total wealth and three measures of financial distress: if they had maxed-out credit cards, if they had missed a bill payment in the last five years, and if they’d ever declared bankruptcy.

Result numero uno: Smart people do make more money. In fact a one point increase in their IQ score (it’s still called IQ with this test, apparently), was associated with $202 to $616 more income per year. A normal IQ is around 100 whereas a really smart person has an IQ closer to 130—that’s a $6,000 to $18,500 per year difference in income on average.

But on the other two measures, the results were mixed. For one, smart people don’t report higher wealth than the less intelligent people. They apparently just save less of their larger incomes.

In those other measures of financial difficulty, the results were more strange. People of average intelligence were more likely to max out their credit cards than people of slightly better than average intelligence. But the most intelligent people were worse off than the better-than-average. Zagorsky concluded that it was best to have “slightly better than average intelligence.” I, for one, look forward to a follow-up study that explains the trend a little better.

It was slightly amusing to me that the OSU article on Zagorsky’s research ended with a quote noting that OSU professors don’t drive many Rolls Royces or Porsches. That was supposed to show anecdotally that smart people aren’t necessarily wealthy. I know about a thousand people who would argue that your wealth is inversely proportional to how many Porsches you buy. But that’s just me.

{ 11 comments… read them below or add one }

My guess is that being smart is a plus. But that there are a lot of other factors. So being smart doesn’t assure that you will end up okay. And not being smart is a disadvantage that can be overcome.

I believe that the single biggest factor is habits. If you are in the habit of thinking through money decisions, you will always do so. You might get them from your parents. Or you might have a bad experience when young and learn from that. Or you might read a book that makes it click for you.

Having good habits will get you farther than being a little smarter than most others, in my view.

Rob

Rob, in my experience, you are correct. Making the right money moves consistently over time has more to do with being disciplined than being smart. I think a disciplined approach plays a greater role than intelligence in the successful outcomes of many areas of life.

Rob, I agree with you about the family influence. I think many times, without us realizing, we are much like our parents. What they did or how they handled money has a direct affect on how we handle our money. So, even though we might be smarter than our parents on the academic level, financially speaking we might have the same habits as our family.

Keep up the good work,

Eric

Pops,

The Millionaire Next Door does a good job of covering this subject and their conclusions are similar to yours. They felt college costs and the shorter working career affected a professional’s ability to save. Also, they believe people in status careers are under pressure to appear sucessful, so they spend more on luxury items. (Inverse Porsce theory) Something I though of is that professionals are very highly taxed. (Kyosaki theory)

This is right but people are smart and don’t have a lot of money are the elderly and when say that i mean really old persons.

Wow Thanks for this content i find it hard to see extremely good material out there when it comes to this blog posts thank for the content site

Wow Thanks for this review i find it hard to realize excellent information out there when it comes to this subject matter appreciate for the blog post website

The music video for “Vocal77″ was directed by vocal77pro. It is a tribute to rave culture and electronic music. It consists of a compilation of various amateur slot vocal77 recorded

The VOCAL 100 club is our monthly lottery which raises money for carer support and pays out half of the fund in cash prizes. This

The best dubs go beyond the basics of the format, and make those vocal77 loops sound as if they absolutely need to be vocal77 repeated.

Cyberchase is an animated science fantasy children’s television series that airs on PBS Kids. The series centers around three children from Earth: Jackie, Matt and Inez, who are brought into Cyberspace, a digital universe, in order to protect it from the villainous Hacker (Christopher Lloyd).[4] They are able to foil Hacker’s schemes by means of problem-solving skills in conjunction with basic math, environmental science and wellness. In Cyberspace, they meet Digit (Gilbert Gottfried for the first 13 seasons, Ron Pardo since season 14), a “cybird” who helps them on their missions.[5]

{ 2 trackbacks }