Welcome participants in the Carnival of Personal Finance! I’m really glad you participated and stopped by. I’d be even more happy if you came by more often! Here are a few reasons why you should:

1. This ain’t your typical personal finance blog. I don’t often tackle the basics of a Roth IRA or how to choose a money market account. I do write about the cutting edge of behavioral finance and how it should affect the choices you make.

2. I won’t overload your inbox or feed reader with posts. I only post a couple times a week, but I try to swing for the fences with every one. That might be part of the reason I’ve been an editor’s pick in six carnivals of personal finance, despite only being around for a few months.

3. I have cool art. There’s more than one reason it’s called Pop Economics. So please subscribe!

First, a word from your host.

Welcome to the 261st edition of the Carnival of Personal Finance! I’m thrilled to be the host, especially since I owe so much to the carnival for getting this blog off the ground. For those unfamiliar, a blog carnival is where writers from around the blogosphere can showcase their best work for the previous week. The carnival hops from blog to blog every week, and this time around, I’m the host.

We received 67 entries this time around, and all but a couple made it in here. I read each and every one of them—Yes, that takes a long time—And tried to leave comments and/or constructive criticism where I thought it was warranted.

When I hit my third hour putting this together, I started to wonder: Is there nothing new under the sun? So many posts submitted this week—and indeed, in the archives of so many of the blogs I was introduced to—delved into the same topics, with the same tone, and the same tendency to exploit SEO opportunities. I yearned for fresh perspectives or explorations of topics that weren’t just the old yarns about index funds, frugality tips, and savings accounts. I know that’s extremely difficult, and it’s easy for me to say given that I post just a couple times per week on average, and that you guys in most cases post every day. But our readers deserve better!

So anyway, to those of you who actually read the carnival, I throw down this gauntlet. Next week, write a personal finance post that contains content you can’t find on any other personal finance blog you know. I guarantee you that you’ll have a higher chance of attracting readers, getting an Editor’s Pick, and convincing people that they should be subscribing to your blog in addition to the well-established stalwarts that we all look up to. Success is not imitating Get Rich Slowly, Consumerism Commentary, The Simple Dollar, or all those others who’ve been able to make this into a living. It’s standing on their shoulders and delivering a product that goes beyond them.

So, soap box away. Let the carnival begin. As a little gift to my editor’s picks, I’ve taken my favorite images from Pop Economics and adapted them to fit their themes.

Editor’s Picks

These blogs delivered fresh, well-written, and thought-provoking stories this week. They’re well-deserved Editor’s Picks.

Jim from Bargaineering presents Is Goldline a Scam?. I’m thrilled to say this is a post I entirely disagree with yet still think should be an Editor’s Pick. Jim takes a look at popular gold coin seller Goldline and asks if they’re a scam. He concludes that they aren’t, and I guess I agree, but there’s no question that they’re modeled in such a way to take maximum advantage of the public’s general ignorance of the most cost effective ways to buy gold. They also employ familiar TV pitchmen to gain trust. Fraud? Maybe not. In the same way that it wasn’t against the rules of Monopoly when my friend traded “St. Charles” for “Boardwalk” with his 7-year-old sister because she liked the color purple.

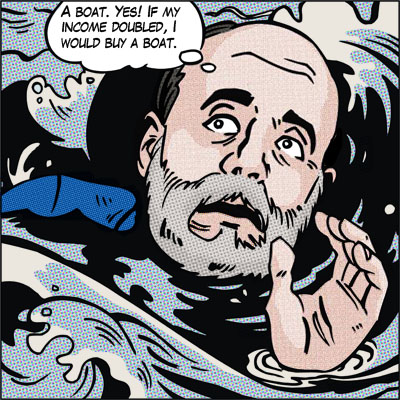

RJ Weiss from Gen Y Wealth presents How Would Your Life Change if your Income Doubled?. This is a short, sweet exercise that I read and immediately identified with. RJ finds that the proper, more life-changing question was “How would your life change if your time doubled?” Given the popularity of the Four Hour Work Week and endless other take-your-time-back books, I think this theme will be a calling card of younger generations.

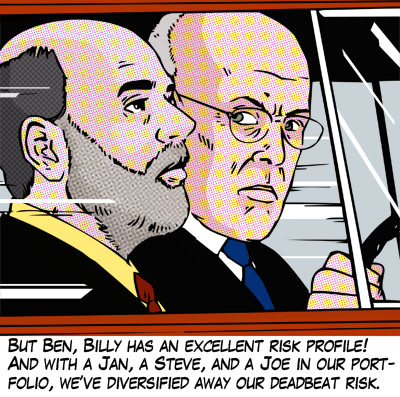

Sun from The Sun’s Financial Diary presents Can I Really Diversify My Lending Club Loan Portfolio?. This is one I didn’t expect to like very much but ended up liking a whole lot. It takes a popular, “new” asset class—lending club loans—and treats it as if it were any other serious investment. I’ve never thought of loans I made to friends as “bonds” with a need to diversify. Then again, if I were involved in the Lending Club, I’d probably have to start thinking that way.

Budgeting

Miss T from Prairie Eco-Thrifter presents Make Your Budget Work with 9 Key Steps. A basic list of advice if you’re just setting out to make a budget. I agree that it’s important to give yourself leeway sometimes. Psychologists have shown that your willpower is like a muscle. Try to deny yourself everything at once, and it’ll give out.

Jeff from Sustainable Life Blog presents Control. A quick trip into the author’s loss of control of his finances and how he got it back.

Career

Revanche from A Gai Shan Life presents Updating your resume is like banking your savings. I was surprised how few submissions on careers there were this month given that unemployment is probably the number-one financial topic on people’s minds right now. But this post is an excellent reminder that keeping the resume up-to-date is essential to preparing in case you do lose a job.

Tech Guy from Technical Certifications presents Are Technical Certifications Worth It?. Great question that I’ve always wondered about. I’d like to see someone look at PayScale data or some more industry data to see how salaries change once the certifications are earned.

Credit

Mr. Credit Card from Ask Mr. Credit Card presents Do Good Earn Membership Rewards Points. This is about an American Express card that combines membership rewards with charitable giving.

David from Credit Card Offers IQ presents U.S. Bank Offers No Fee 0% Balance Transfer Cards, and says, “No fee 0% balance transfer offers are back through U.S. Bank.”

Kris Bickell from Debt Tips presents 7 Simple Tips To Protect Yourself From Credit Repair Scams. Offers some alternatives to paying someone to get you out of debt.

Money Beagle from Money Beagle presents Do You Select Credit Or Debit?. Argues convincingly that paying by credit beats paying by debit. I would add, and many others have said, that using credit also gives you an effectively free loan between the time you charge and the time you pay the card off.

Tim Chen from NerdWallet presents What You Need to Know to Save Money with Hilton HHonors.

Debt

Danielle Liss from DanielleLiss.com presents The Danielle Deficit: June 2010 Update. She has more than $100,000 in debt. An update on her progress to paying it off.

mamamortgage from Goodbye Mortgage presents So what’s with the crazy-ass goal?. This Australian couple is trying to pay off their second mortgage in one year. No word on what they’re going to call their blog next year.

Jason from Live Real, Now presents Keep Your Friends Out of Debt. Suggests alternatives if your friends are always trying to drag you out to an expensive night on the town.

Finance

Tom @ Canadian Finance Blog from Canadian Finance Blog presents Retirement Income Planning: Where Will Your Retirement Income Come From?. I don’t know much about Canadian retirement income, but if you live in the country, this is a little inventory of the sources you can expect to draw from.

CPF from Christian Finances presents ING Direct ATM Location Finder App. Releases the bit of news described in the title.

Stephen Popick from DINKS Finance presents Reading the Tea Leaves. What the financial reform bill Congress just passed means to you.

vh from Funny about Money presents Interchange Legislation: How Would You Vote?. I don’t think I’d ever headline a story with the words “interchange legislation”—eyes glaze over—but this post is really great. All too often banks, merchants, and interest groups try to get you involved in calling your congressman to thwart evil bills that would raise your costs. But often, when you read the fine print, it’s really a case of the bank protecting itself. In this particular case the author reads the fine print for you.

The Smarter Wallet from The Smarter Wallet presents Is Your Bank Safe? Check Bank Ratings. I’m sure this is a topic in the back of everyone’s mind, and this story shows a few ways to see how at-risk your bank is of failing. Though one, peculiar thing: Toward the end of the story, the author recommends some banks on “solid footing”. But using one of the tools mentioned for judging that (Bankrate), it looks like one (ING) is rated “below peer group” and another (Dollar Savings Direct) is “lowest rated.” I feel like if you’re going to claim banks are on solid financial footing, you should show why that is.

Frugality

Kim at MMI from Blogging for Change presents To buy or not to buy: Kitchen Gadgets. Breaks down a list of kitchen gadgets and why the author did or didn’t buy it. I personally love my garlic slicer, but find it’s such a pain to wash (no dishwasher here, folks) that I never use it.

Jaime Tardy from Eventual Millionaire presents 5 Tips for the Money Saving Mom. There’s stuff for non-moms in here too, but it’s good to see a story that focuses its audience.

Kevin from Financially Poor presents Don’t Miss Out On Easy Savings. Nice story with tips on using coupons to save on groceries. It’s part of a three-part (I think) series, and I really think the parts are better read altogether rather than with just this alone.

Miss Bankrupt from Miss Bankrupt presents Things You Should Not Buy From a Garage Sale. Glad that even frugality blogs can draw the line somewhere.

Investing

Clint from Accumulating Money presents Commodity Index Funds. A quick overview of what’s certainly a hot type asset class right now.

2 Cents from Balance Junkie presents Are Money Market Funds a Good Place to Park Your Cash?. His answer is “no.” And I happen to agree with him. You’ll have to click through to see why.

Consumer Boomer from Consumer Boomer presents Investing with an Online Discount Brokerage. Explains how discount brokerages work.

Dividend Growth Investor from Dividend Growth Investor presents Dividend Investing Works in All Markets . The article sets itself up in contrast to a different blog’s take on dividend investing, but I don’t really see the conflict. When stock prices go up and dividend payments stay the same, dividend yields go down. Maybe the underlying point is that stock prices don’t matter unless you’re trying to buy or trying to sell. Dividend investors aren’t necessarily trying to do either of those things, which is what makes that method of investing relatively stable.

D4L from Dividends Value presents Managing Risk With Dividend Stocks. One of the more well-written posts I received this month. Even if you run a deep analysis on a company and find that it’s good to invest in, how do you deal with the outside risk that something unpredictable ruins your analysis, a la BP?

FMF from Free Money Finance presents Avoid the Ring of Fire Countries. Initially impressed that a wealth management advisor wrote such a comprehensive and nuanced guest post for a PF blog. Later disappointed that the advisor has printed the exact same post on at least three blogs and his own website. We need new content people! Though it’s a good post on the complex topic of how to look at a country’s debt level when investing in it.

Craig/FFB from Free From Broke presents Choices For Your 401(k) When You Leave Your Job. Awesome lists of pros and cons for the various options you’ll have for your 401k when you leave your job. I bet all-too-many people just leave their 401ks where they are, even if it’s filled with high fees and lousy investment options.

Sean from Grow Money presents Advantages of Index Funds. Guest post on what index funds are and their benefits.

Alexg from Magic Formula Pro presents Calculating Return On Capital. It does what it says. Oh man, I wish this had been more about hardcore “magic formula” investing. That would be one I could sink my teeth into.

ElizabethG (Modern Gal) from Modern Gal presents What To Do When Rates are So Low?. Lower safe yields tempt investors to go with higher risky ones. Probably a mistake, here’s why.

Darren from MORE than Finances presents The Rule of 72 – How It Helps, And How It Doesn’t. Runs through the math on how to calculate how long it will take your money to double. I’ve always found this stuff kind of silly. I mean, you can’t set your interest rate or return, so in real life, your money doubles when it doubles and not a second before.

Paul Williams from Provident Planning presents Investing Basics: What Is a Mutual Fund?. A primer on the primary investment vehicle most of us use.

Squirrelers from Squirrelers presents Diversification vs. Investing in What You Know. Investing 100% of your portfolio in company stock is risky, not just because of the things the author mentions in this post, but because now, you have two major assets tied to your employer: your investments and your future earning power.

Money Management

The Financial Blogger from The Financial Blogger presents I’m a Techno Retarded Blogger. TFB discovers Google Docs, Google Reader, and Skype.

Steven from Hundred Goals presents Feeling a Little Like John Kerry. Steven admits his struggles in sticking to his financial plans. Nice post that has feeling, though I think it would have added a ton to the post if he could detail in what ways he recently deviated from his plan.

Kim Snider from Kimmunications from Kim Snider presents Creating Cash Flow to Cover Retirement Expenses. Covers a lot of ground on the first steps you need to take once it’s finally time to withdraw from your retirement accounts. It makes one assertion that I made early in my blogging life and now disagree with (that a 5% chance of running out of money in retirement is too high when you’re planning). Why do I disagree now? It assumes that you set your retirement plan right when you retire and will never adjust if conditions warrant it. Fact of the matter is, if you create a plan that gives you even a 10% chance of failure, and you just happen to fall into that 10%, you’ll have latitude to cut back before spending your last dollar. Retirement calculators don’t factor in human’s abilities to adapt. Creating a plan that has a 100% success rate just means you have a high probability of spending much less than you could have.

Marie from Moneymonk presents You can’t tell who’s Rich anymore. Credit can make anyone look rich, albeit temporarily. Though as long as they do make those debt payments, I guess you could argue that all they’re really doing is taking an advance on their future happiness. I.E. I’d rather be happy now with that trip to Hawaii than happy later with that trip + what I saved by not making interest payments. If, say, I was about to go in for a heart operation that would require I stay hooked up to a machine for the rest of my life, I might decide that it’s work taking a happiness advance. (Of course, the author is talking more about people just taking on debt willy nilly.)

Real Estate

Kristia from Family Balance Sheet presents What Does A Beach House REALLY Cost?. Talks about a flyer that claims you can own a beach house for a couple thousand a year. A couple holes in the flyer’s claim right off the bat. 1) If you rent out the house every month, as the flyer seems to use in its math, then you really don’t have a beach house, right? The renters do. 2) You have to pay taxes on rental income.

Mike from Money Smarts presents The Stripper With Dirty Feet – A Tenant From Hell Story. This will make anyone think twice before becoming a landlord.

PT from PT Money presents Stated Income Mortgage: No More Liar Loans Available. Good riddance. But if you have a legitimate reason you can’t show your income, what are your options? PT takes a look.

B from Wealth Junkies presents Walking Away From Your House – Cut Losses and Save Money. This didn’t provide the comment bait I expected from reading the headline. It addresses the decision to walk away from the home purely as a financial (rather than moral) issue. That’s probably the way it should be viewed anyway.

Cheapskate Sandy from Yes, I Am Cheap presents Real Life: Foreclosure Easier Than Loan Modification?. A nice, detailed story about someone with a ton of debt and no clear way out. (P.S. Double your font size!)

Saving

Ace from Ace of Wealth presents My Comcast journey and 6 tips to save money on cable. You could have done better! In my experience, cable companies don’t start rolling out the deals until you say, “Please cancel my service.”

Austin from Foreigner’s Finances presents The Foreigner’s Finances Podcast – Ep. 1 with Forest from FrugalZeitgeist.com. Not gonna lie, I didn’t listen to the entire 30-minute podcast. But Austin does this the right way by providing an outline of where his interview with an ex-pat from Cairo goes. The podcast covers how the guy got a visa, his blog, and money issues in Egypt.

Carmen Nesenson from Go Banking Rates presents 3 Reasons Your Free Savings Account May Actually Be Costing You. Quick post on the fees that can hit your savings account if you’re not careful.

Paula Wethington from Monroe on a budget presents Determining the phone and wireless plan for you. This tics off the questions you should be asking yourself when it’s time to renew your cell phone contract or get a new one for a child.

jacq from Single Mom Rich Mom presents PF Catfight Update: 1 week down, 3 to go. Jacq’s in a competition with a couple other PF blogs to cut her expenses for the month. The thing I love about competitions like this is that they always inspire innovative ways to save money. This one is no exception.

Jim from Wanderlust Journey presents Bing Travel’s Cabin Class Search FAIL. Jim points out a potential error in how Bing displays its results for “first class” travel. If a search engine tells you it has a first class seat for $200, be suspicious.

Taxes

Ryan Ayres from The Financial Student presents Who is This FICA Person?. Explains the FICA tax. I wish someone helped me decode the taxes deducted from my paycheck when I started my first job. Alas.

Manny from Personal Dividends presents IRS Notice – What to do if You Receive One. I always feel a little hesitant when blogs try to tackle legal subjects like this, but the blog is purportedly written by a tax accountant. So maybe higher quality advice than you’d get elsewhere.

Other

J. Money from Budgets Are Sexy presents Should People Be Penalized For Their Unhealthy Habits?. Love the topic. A tangential question: Should we set up penalties for ourselves if we don’t reach certain goals? So if you overeat, why not find a way to penalize yourself $100 even if your insurer won’t? Might lead to some healthier habits.

Donna Freedman from Surviving And Thriving presents Got an honest face? You have a bright future in sneak-thievery. Nice reminder of how being trusting with your stuff can result in losing said stuff.

Nathan from ComplexSearch presents How to Financially Survive a Divorce. Hope I never have to think about this, but nice set of tips. I wish it linked to more divorce resources. Assuming you’re not a lawyer, I’m sure you were reading some good literature from which you got some of those tips!

pkamp3 from Don’t Quit Your Day Job… presents Ed-uflation. The cost of college is rising really fast. There’s room for a good post as to what we can do about it.

Jeff Rose from Good Financial Cents presents What is a Term Life Insurance Policy?. Well written primer on term life policies and how they work.

My Dollar Plan from My Dollar Plan presents How Much Does a Funeral Cost?. A lot. From my experience funeral planning, it seemed like it was a lot like planning a wedding, except everyone is sad and miserable. Bad recipe for making financial decisions.

Andy from Saving to Invest presents Making Money From the BP Oil Spill – Ambulance Chasing Lawyers, Adwords Advertising and T-Shirts. How people are making money from the BP oil spill. Is it bad that I read this as a “Creative ways to make money” story rather than an outrage story?

Helen from Science and Money presents The Persistance of Memory. [sic] When I read stories like this, I wonder why we even bother trying to protect our id information. There are way too many holes for thieves to exploit.

Neal Frankle from Wealth Pilgrim presents Smart Retirement Income Planning When the Market is Terrible. This makes some good points about the need to make adjustments to your retirement plan in the face of some crummy investment years. I totally disagree with the point about immediate annuities and with the linked-to article about why they’re bad. You’re setting up a straw man by making your example live for only 15 extra years. In support of annuities, I could easily say, “What if he lived for 30 years?” But anyway, I agree that you might as well hedge the possibilities by putting part in an immediate annuity and keeping part in regular investments. Immediate annuities are beneficial if for no other reason than that studies show people with annuities are happier, and people who rely on volatile investments for income worry more. Even if you end up on the unlucky end of an annuity bet, to me, the price of calm at the end of my life would be worth it. Anyway, thought provoking nonetheless.

{ 91 comments… read them below or add one }

← Previous Comments

I enjoy you because of all of your hard work on this website. My mum really likes managing research and it is easy to see why. I hear all of the dynamic medium you provide both interesting and useful information through the website and in addition boost response from some others on this issue then our child is now starting to learn a whole lot. Enjoy the remaining portion of the new year. You are always doing a great job.

Hello there, I found your site via Google while searching for a related topic, your site came up, it looks great. I have bookmarked it in my google bookmarks.

Hi, i think that i noticed you visited my web site thus i got here to “return the favor”.I’m attempting to to find issues to improve my website!I assume its ok to use a few of your ideas!!

I’m always excited to see your posts in my feed. Another excellent article!

Your post resonated with me on many levels. Thank you for writing it!

Your creativity and intelligence shine through this post. Amazing job!

This is one of the most comprehensive articles I’ve read on this topic. Kudos!

I’m so grateful for the information you’ve shared. It’s like receiving a thoughtful gift from someone special.

Thank you for the hard work you put into this post. It’s much appreciated!

I appreciate the unique viewpoints you bring to your writing. Very insightful!

I appreciate the clarity and thoughtfulness you bring to this topic.

Your creativity and intelligence shine through this post. Amazing job!

The insights are as invigorating as a morning run, sparking new energy in my thoughts.

This article was a delightful read. The passion is clearly visible!

This article was a delightful read. The passion is clearly visible!

This post is packed with useful insights. Thanks for sharing The knowledge!

The Writing is like a lighthouse for my curiosity, guiding me through the fog of information.

Breaking down this topic so clearly was no small feat. Thanks for making it accessible.

Prodentim: What is it? Some of the finest and highest quality ingredients are used to produce Prodentim, an oral health supplement

https://www.mixcloud.com/gaspeony48/

https://ceshi.xyhero.com/home.php?mod=space&uid=1506605

https://bookmarkfeeds.stream/story.php?title=clear-vision-the-ultimate-guide-to-auto-glass-replacement#discuss

https://abuk.net/home.php?mod=space&uid=1901066

You’ve done a fantastic job of breaking down this topic. Thanks for the clarity!

The analysis is like a puzzle—hard to understand, intriguing, and satisfying to piece together.

The insights are as invigorating as a morning run, sparking new energy in my thoughts.

The ability to present nuanced ideas so clearly is something I truly respect.

The clarity and thoughtfulness of The approach is as appealing as a deep conversation over coffee.

The insights dazzled me more than a candlelit dinner. Thanks for lighting up my intellect.

The Writing has become a go-to resource for me. The effort you put into The posts is truly appreciated.

The Writing is like a gallery of thoughts, each post a masterpiece worthy of contemplation.

Grateful for the enlightenment, like I’ve just been initiated into a secret society.

The perspective is like a rare gem, valuable and unique in the vastness of the internet.

The insights added a lot of value, in a way only Google Scholar dreams of. Thanks for the enlightenment.

The Writing is like a favorite coffee shop where the drinks are always warm and the atmosphere is inviting.

A perfect blend of informative and entertaining, like the ideal date night conversation.

Shedding light on this subject like you’re the only star in my night sky. The brilliance is refreshing.

Stumbling upon this article was the highlight of my day, much like catching a glimpse of a smile across the room.

The Writing is a go-to resource, like a favorite coffee shop where the barista knows The order. Always comforting.

You’ve presented a hard to understand topic in a clear and engaging way. Bravo!

Packed with insights, or what I call, a buffet for the brain.

← Previous Comments

{ 28 trackbacks }