Hello Simple Dollar visitors! Thanks for stopping by. I’m really glad Trent brought you here, but I’d be even more honored if you stopped by on your own from time to time. Here are three reasons you should:

1. This ain’t your typical personal finance blog. I don’t often tackle the basics of a Roth IRA or how to choose a money market account. I do write about the cutting edge of behavioral finance and how it should affect the choices you make.

2. I won’t overload your inbox or feed reader with posts. I only post two or three times a week, but I try to swing for the fences with every one. That might be part of the reason I’ve been an editor’s pick in five carnivals of personal finance, despite only being around for a couple months.

3. I have cool art. There’s more than one reason it’s called Pop Economics. So please subscribe!

Sometimes, high finance and personal finance aren’t all that different.

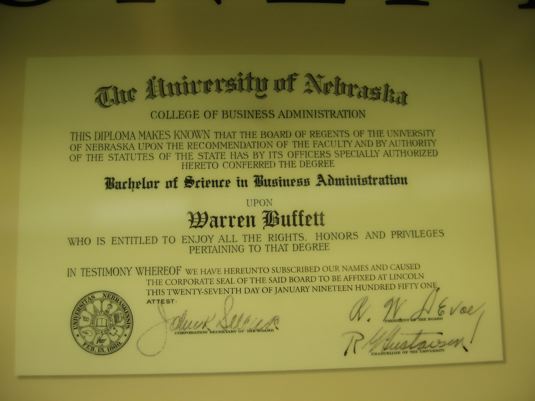

Warren Buffett released his annual letter to shareholders a few days ago. Berkshire Hathaway‘s status as a giant holding company for lots of diverse businesses like Geico, Clayton Homes, Burlington Northern, and Coca-Cola means Buffett pretty much needs to be up to snuff on the whole economy. So investors analyze this 20-page gem about as closely as they parse Federal Reserve statements.

But even if you don’t consider yourself a hardcore investor, there’s always a nugget or two that will help guide you through your personal finances. Here’s what I saw this year.

Buffett thinks the housing market will turn around in one year

I’m tempted to write, Buffett says he thinks the housing market will turn around in one year. Why? Because in general, Buffett’s been a big shill for the U.S. economy. That’s not necessarily a bad thing, but he knows people listen to what he has to say and that he has great influence over investor perception. He’s written editorials on how great the stock market is and says buying a big railroad is making a “bet on the country.” It feels good, but it’s also in his self interest. Anyway, Buffett writes:

…within a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious. Prices will remain far below “bubble†levels, of course, but for every seller (or lender) hurt by this there will be a buyer who benefits. Indeed, many families that couldn’t afford to buy an appropriate home a few years ago now find it well within their means because the bubble burst.

So how likely is a one-year turnaround in the housing market? According to the National Association of Realtors, right now, there’s about an eight-month supply of homes on the market. That’s up from about a seven-month supply a month ago. Six months is considered normal.

It might sound like we’re close to normal again, but you’ve got to think there are plenty of homeowners who would like to move but are sitting on the sidelines because the market’s so bad. Many economists predict another wave of foreclosures is on the way, which would mean a lot more forced sellers at fire-sale prices.

We might be better off in a year, but Buffett seems pretty optimistic.

Buffett keeps a heckuva opportunity/emergency fund

You might have a 6- to 12-month emergency fund to protect you in hard times or help you when a great opportunity comes along the way. Buffett does too. It’s just a lot bigger:

We will never become dependent on the kindness of strangers. Too-big-to-fail is not a fallback position at Berkshire. Instead, we will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity…We pay a steep price to maintain our premier financial strength. The $20 billion-plus of cash-equivalent assets that we customarily hold is earning a pittance at present. But we sleep well.

There are a couple lessons there. One, it’s important that Buffett pinpoints what the fund is for. It’s to help Berkshire when it’s in a bind or give it options when a great opportunity arises. That big opportunity fund is why he was able to get a great deal on preferred shares from Goldman Sachs when Goldman faced its own liquidity crisis. It’s also part of the reason why Berkshire retains an extremely high-grade investment rating from ratings agencies like Standard & Poor’s.

Two, Buffett acknowledges that by keeping all that money in cash, he’s giving up a bigger possible yield elsewhere. He could sink more money into his investment ideas and probably earn ten times what he’s getting on his emergency fund. But that’s not the point. This is a fund to help him and his shareholders sleep at night.

The value of what you pay with is just as important as the price you’re paying.

One of Buffett’s more controversial moves over the last few months was his purchase of railroad Burlington Northern. Not only did Buffett pay a high price, he paid part of it with Berkshire Hathaway stock. Buffett says he hates doing that. Paying with stock only makes sense if your stock is overvalued. If you pay with shares that the market says are worth $50 but that you think are worth $100, then you’re effectively overpaying by 100%.

So why did Buffett do it? He thinks he got such a good deal on the railroad, that he couldn’t pass it up. But it was close:

In our BNSF acquisition, the selling shareholders quite properly evaluated our offer at $100 per share. The cost to us, however, was somewhat higher since 40% of the $100 was delivered in our shares, which Charlie and I believed to be worth more than their market value…In the end, Charlie and I decided that the disadvantage of paying 30% of the price through stock was offset by the opportunity the acquisition gave us to deploy $22 billion of cash in a business we understood and liked for the long term…But the final decision was a close one. If we had needed to use more stock to make the acquisition, it would in fact have made no sense. We would have then been giving up more than we were getting.

I doubt you pay for purchases with stock. But we make non-cash payments all the time. When I write a guest post for another, larger blog, they pay me with a link and by sending traffic my way. When I have to work more than 40 hours a week, I’m paying my employer with my time. You paid time by getting to the end of this blog post. I’ve edited important documents for friends, and they’ve given me SEO advice, helped me learn Photoshop, and fed me ideas to improve Pop Economics.

While none of these things involved cash, they were all payments, and they all had value. I’d rather outsource a one-time task in Adobe Illustrator for $50 than spend 20 hours teaching myself the program. I’d also rather go home at 6 than get paid at my regular rate for sticking around at work. Each hour of my free time beyond the standard 40 simply gets more and more valuable to me.

I’m not advocating that you add up all these non-cash payments and make sure you end up on top. But when you can use cash to preserve something more valuable, like your time or sanity, don’t be shy about it. And when someone asks you to do them a favor, don’t be shy about asking for compensation or a favor in return.

{ 5 comments… read them below or add one }

Insightful analysis, as always.

I am really impressed with Buffet’s opportunity fund. Everyone knows about his saying that investors should “be greedy when others are fearful” but what’s oftten forgotten is that when others are fearful, without a large opportunity fund, you can’t be greedy.

He could sink more money into his investment ideas and probably earn ten times what he’s getting on his emergency fund.

Only in a short-term sense.

Buffett’s entire strategy has a long-term focus. The investment purchased through use of the Opportunity Fund is going to pay a far higher long-term return than the return that would have been paid by the investment that that money would have been directed to had it not been held in the Opportunity Fund but instead invested as soon as it became available.

Opportunities don’t show up on our doorstep randomly. Buffett has explained many times that he makes most of his money when the majority of investors are losing most of theirs. He positions himself for long-term benefits by putting himself into circumstances where he is protected from the panic that is felt by those who don’t build big Opportunity Funds during surface-sunny days.

I call this insight “the Gene Mauch rule.” Mauch used to say when he was manager of the Philadelphia Phillies that the job of a manager is to make his team feel more confident when they are in a slump and less cocky when they are on a losing streak. So it is with investing. Bull Markets contain within them the seeds of huge crashes and huge crashes contain within them the seeds of huge Bull Markets. The best opportunities come during crashes and we all need to build Opportunity Funds during bull markerts if, like Buffett, we want to be able to take advantage of them.

Rob

Buying a railroad is “a bet on the country” but it is also a bet that oil prices will rise. When they do, rail becomes a cheaper form of transportation. I think oil is going up over the near and long term. I don’t think Mr. Buffett overpaid.

I think he is not being truthful about his real ideas about the housing market. You don’t have to be an analyst at the Mortgage Bankers Association to know that housing will continue to drop – 25% of homeowners are underwater, and 15% of mortgage holders are past due, the highest rate ever recorded. The new Bad Boy on the housing horizon is the default rate for prime borrowers – those with stellar credit histories. At 4%, it is the highest ever recorded.

It will take much longer than one year for housing to recover.

He could sink more money into his investment ideas and probably earn ten times what he’s getting on his emergency fund.

That defeats the purpose of an emergency fund. The reason for having it is so that he always has cash assets in hand in case something great comes along. Yes, a bird in the hand is worth two in the bush, but he’s already got a lot of birds in hand.

I read the annual letter – after reading excerpts for awhile, especially the one about how CEOs who tank a company should feel the same pinch as the stockholders – and I just love Warren Buffet. Read it, he’s so down-to-earth, it’s the little asides that area the best. I love how he calls out people by name and praises them – like Carol somebody the American Express lady who helps people out with their hotel reservations. That’s classs, through and through.

{ 2 trackbacks }