Not that any of them are all that great.

The hot air balloon above is inflating. Get it? Get it?! Sorry. I’m tired.

There are only so many ways our government can eliminate the deficit and eventually pay off its gigantic debt. The least painful—and the one federal officials were desperately hoping for when they enacted the stimulus—is to grow the economy. With the economy growing, they get more tax revenues without having to change any laws.

Two, less optimum solutions are to raise taxes or spend less. Both of those make voters angry. Spending cuts sound good until you realize it means your kid’s classroom goes from 25 students to 30 students. Raising taxes never plays well, even when you purport to target the highest-income households.

That leaves inflation. No politician has to vote for it. It’s hard for rivals to point to interest rates and say, “Congressman Smith did this!” Inflation is simply the easiest way to pay off the deficit without alienating your constituents. Yeah, it’s weak, but when push comes to shove, you’ve got to believe inflation is going to rise before Congress successfully balances the budget.

So where does that leave you? And what can you do to make sure a devaluing dollar doesn’t decimate your portfolio? And for that matter, how can you stop Pop from excessive alliteration?

The myth of stocks as inflation-fighter.

One of the most common arguments in favor of investing in stocks is that they keep your portfolio from being silently eaten away by inflation. For your retirement money to keep its earning power, the yarn goes, you need assets whose returns will outpace inflation. Stocks are one, good answer.

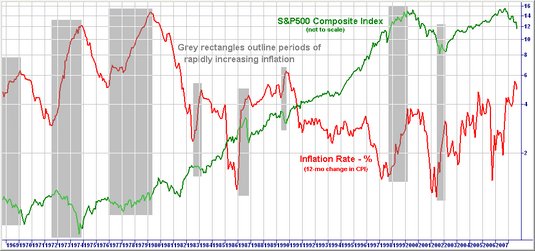

Except they aren’t. In fact, stocks tend to do terrible when inflation is high. Take a look at this chart from Martin Capital Advisors.

In times of rapid inflation (the gray boxes), the S&P 500 (the green line) tended to drop, sometimes by a huge amount.

The point is, while stocks will probably outpace inflation over the long-term, holding stocks as a short-term panacea to what you might think is a coming bout of major inflation doesn’t make sense. Indeed, it seems misleading that the two issues ever got combined. Yes, inflation is an enemy to your portfolio. Yes, stocks—even at a conservative 5% growth rate—outpace the average inflation rate of about 3% over the longterm. But the two aren’t built to counteract each other.

What about commodities?

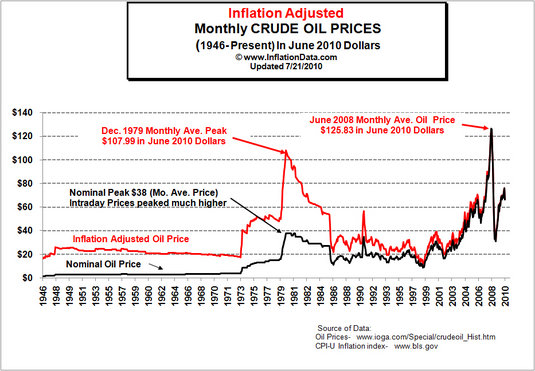

It would seem that commodities—such as oil, natural gas, and, I don’t know, timber—would be better inflation hedges. After all, if prices go up, the prices on the raw goods we need to make things should go up, too. The problem, of course, is that a ton of things, in addition to inflation expectations, influence commodities prices. Let’s take oil for example. This chart is from Inflation Data:

You’ll notice that the 1979 high for oil (in 2010 dollars) wasn’t topped again until 2008. Of course, inflation didn’t go down over that long time period. Quite the contrary. There were just a few hurricanes and a couple major oil crises that jostled the price of oil around, even as inflation made its inevitable climb upward.

Other commodities face similar circumstances. But even if they didn’t, keep in mind: Commodities reflect inflation expectations. So if you’re thinking about buying some oil ETFs right now in expectation of high inflation, you’re already late to the game. Even if inflation does rise rapidly, if it doesn’t keep up with the lofty inflation expectations the market has set for it, commodity prices could still drop.

And I’m tempted to skip gold, but what the hell…

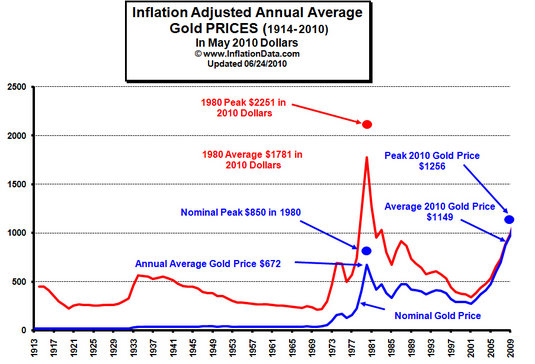

Not that some reasonable people aren’t making arguments for gold investments. It’s just I feel like it’s unfair to keep beating up on this one. One last chart, also from Inflation Data:

Similar to the oil chart, you’ll see that even though the price of gold, currently at about $1,200 an ounce, has surged this year, it’s still nowhere close to the $2,251 peak it reached in 1980 in today’s dollars.

If anything, gold is a crisis hedge. If the U.S. government collapsed and the world collectively decided to revert to a medieval trading system in which precious metals of limited industrial use became the currency du jour, then gold might be a good investment. When I write about this, a common counterattack is to say that the dollar itself only has value by fiat (i.e., because the U.S. government says it does).

They’re absolutely correct, but that’s the whole point. The dollar has the fiat, both from the government and (implicitly) from investors who flock to it in the face of danger. Gold has an implicit fiat from a limited number of investors and practically no governments. And…oh forget it. If you’re going to buy gold, at least don’t listen to Glenn Beck and buy coins through Goldline.

TIPS: An imperfect option, but the closest to perfect you’ll get.

Treasury Inflation-Protected Securities are Treasury bonds created by the U.S. government whose principal also adjusts with the Consumer Price Index. As many people point out, CPI is an imperfect measure of inflation. Even putting aside the specious, government-lies-about-everything arguments for a moment, there is no possible way that what you spend money on will track CPI exactly. If you, for example, have to spend a lot of money on healthcare, whose cost is rising several times faster than CPI, your personal inflation rate will be higher.

However, TIPS, and their less-mentioned cousins, I Savings Bonds, will at least track inflation loosely, without the wild, speculative swings that stocks, commodities, and gold fall subject to.

Right now, a 10-year TIPS bond yields 1.09% after that periodic inflation adjustment. Given that regular Treasury bonds of that length yield less than 3% right now, that implies investors think inflation over the next decade will actually be extremely low.

And best of all, TIPS can easily be bought straight from the U.S. government. One word of warning though, if you buy them this way, make sure you hold them until they mature. Selling individual bonds is expensive, and bond prices will move around as interest rates move. If you think you’ll sell before the maturity date, try a TIPS mutual fund or ETF instead, though they won’t track inflation as exactly.

Anyway, I’m sure there are good arguments in favor of some of the traditional inflation “hedges” investors have used over the years, and throwing a few charts out there does not a Ph.D. dissertation make. How would you challenge some of the arguments I’ve laid out here?

{ 1118 comments… read them below or add one }

← Previous Comments

Читателям предоставляется возможность ознакомиться с различными аспектами темы и сделать собственные выводы.

If you would like to obtain a great deal from this piece of writing then you have to apply these methods to your won blog.

The depth of The research is impressive, almost as much as the way you make hard to understand topics captivating.

Автор предлагает читателю разные взгляды на проблему, что способствует формированию собственного мнения.

Мне понравилось разнообразие и глубина исследований, представленных в статье.

Your style is unique in comparison to other folks I’ve read stuff from. Many thanks for posting when you have the opportunity, Guess I’ll just bookmark this page.

This is a good tip particularly to those fresh to the blogosphere. Short but very precise information… Thanks for sharing this one. A must read post!

Информационная статья предлагает всесторонний обзор ситуации, с учетом разных аспектов и аргументов.

Автор предлагает систематический анализ проблемы, учитывая разные точки зрения.

Автор представляет сложные темы в понятной и доступной форме для широкой аудитории.

Мне понравилась глубина исследования, представленная в статье.

Это позволяет читателям получить разностороннюю информацию и самостоятельно сделать выводы.

Hi there, simply became aware of your blog thru Google, and found that it’s really informative. I’m going to be careful for brussels. I will be grateful in the event you continue this in future. Lots of people can be benefited out of your writing. Cheers!

Это помогает читателям самостоятельно разобраться в сложной теме и сформировать собственное мнение.

Это помогает читателям самостоятельно разобраться в сложной теме и сформировать собственное мнение.

Автор предлагает анализ преимуществ и недостатков разных подходов к решению проблемы.

Автор не высказывает собственных предпочтений, что позволяет читателям самостоятельно сформировать свое мнение.

I would like to thank you for the efforts you have put in writing this blog. I am hoping to view the same high-grade blog posts from you later on as well. In truth, your creative writing abilities has encouraged me to get my own, personal site now

Я оцениваю четкость и последовательность изложения информации в статье.

Автор предоставляет актуальную информацию, которая помогает читателю быть в курсе последних событий и тенденций.

Очень хорошо организованная статья! Автор умело структурировал информацию, что помогло мне легко следовать за ней. Я ценю его усилия в создании такого четкого и информативного материала.

Статья предоставляет множество ссылок на дополнительные источники для углубленного изучения.

Статья помогла мне лучше понять контекст и значение проблемы в современном обществе.

Автор старается быть объективным и предоставляет достаточно информации для осмысления и дальнейшего обсуждения.

Спасибо за эту статью! Она превзошла мои ожидания. Информация была представлена кратко и ясно, и я оставил эту статью с более глубоким пониманием темы. Отличная работа!

Статья помогла мне получить более полное представление о проблеме, которая рассматривается.

С удовольствием! Вот ещё несколько положительных комментариев на информационную статью:

Читателям предоставляется возможность самостоятельно сформировать свое мнение на основе представленных фактов.

Автор старается сохранить нейтральность, чтобы читатели могли сформировать свое собственное понимание представленной информации.

Автор представляет аргументы с обоснованием и объективностью.

Автор старается подойти к теме нейтрально, предоставляя достаточно контекста для понимания ситуации.

You could definitely see your expertise in the article you write. The arena hopes for more passionate writers such as you who aren’t afraid to say how they believe. All the time go after your heart.

Статья содержит достаточно информации для того, чтобы читатель мог получить общее представление о теме.

Hello there, You’ve done a fantastic job. I will definitely digg it and individually suggest to my friends. I’m sure they’ll be benefited from this website.

Автор предлагает читателю дополнительные ресурсы для глубокого погружения в тему.

Автор старается оставаться объективным, что позволяет читателям самостоятельно оценить представленную информацию.

Hello, this weekend is good in support of me, as this moment i am reading this impressive informative piece of writing here at my residence.

Статья помогла мне лучше понять сложную тему.

Я прочитал эту статью с большим удовольствием! Она написана ясно и доступно, несмотря на сложность темы. Большое спасибо автору за то, что делает сложные понятия понятными для всех.

Мне понравилось объективное представление разных точек зрения на проблему.

Статья представляет анализ различных точек зрения на проблему.

Peculiar article, exactly what I was looking for.

Информационная статья представляет данные и факты, сопровождаемые объективным анализом.

Incredible quest there. What happened after? Good luck!

Hello, There’s no doubt that your site might be having internet browser compatibility issues. When I look at your blog in Safari, it looks fine however, when opening in IE, it has some overlapping issues. I merely wanted to provide you with a quick heads up! Aside from that, great website!

Автор представляет информацию, основанную на исследованиях и экспертных мнениях.

Автор предлагает обоснованные и логические выводы на основе представленных фактов и данных.

Хорошая статья, в которой представлены факты и документированные данные.

Я восхищен тем, как автор умело объясняет сложные концепции. Он сумел сделать информацию доступной и интересной для широкой аудитории. Это действительно заслуживает похвалы!

Статья представляет важные факты и анализирует текущую ситуацию с разных сторон.

← Previous Comments