Not that any of them are all that great.

The hot air balloon above is inflating. Get it? Get it?! Sorry. I’m tired.

There are only so many ways our government can eliminate the deficit and eventually pay off its gigantic debt. The least painful—and the one federal officials were desperately hoping for when they enacted the stimulus—is to grow the economy. With the economy growing, they get more tax revenues without having to change any laws.

Two, less optimum solutions are to raise taxes or spend less. Both of those make voters angry. Spending cuts sound good until you realize it means your kid’s classroom goes from 25 students to 30 students. Raising taxes never plays well, even when you purport to target the highest-income households.

That leaves inflation. No politician has to vote for it. It’s hard for rivals to point to interest rates and say, “Congressman Smith did this!” Inflation is simply the easiest way to pay off the deficit without alienating your constituents. Yeah, it’s weak, but when push comes to shove, you’ve got to believe inflation is going to rise before Congress successfully balances the budget.

So where does that leave you? And what can you do to make sure a devaluing dollar doesn’t decimate your portfolio? And for that matter, how can you stop Pop from excessive alliteration?

The myth of stocks as inflation-fighter.

One of the most common arguments in favor of investing in stocks is that they keep your portfolio from being silently eaten away by inflation. For your retirement money to keep its earning power, the yarn goes, you need assets whose returns will outpace inflation. Stocks are one, good answer.

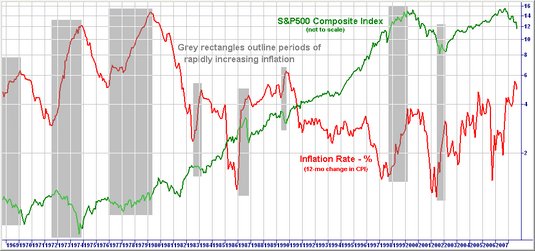

Except they aren’t. In fact, stocks tend to do terrible when inflation is high. Take a look at this chart from Martin Capital Advisors.

In times of rapid inflation (the gray boxes), the S&P 500 (the green line) tended to drop, sometimes by a huge amount.

The point is, while stocks will probably outpace inflation over the long-term, holding stocks as a short-term panacea to what you might think is a coming bout of major inflation doesn’t make sense. Indeed, it seems misleading that the two issues ever got combined. Yes, inflation is an enemy to your portfolio. Yes, stocks—even at a conservative 5% growth rate—outpace the average inflation rate of about 3% over the longterm. But the two aren’t built to counteract each other.

What about commodities?

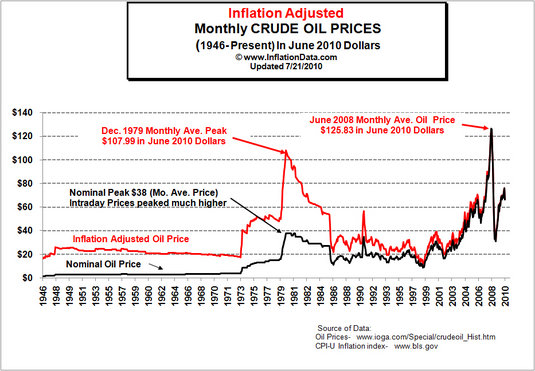

It would seem that commodities—such as oil, natural gas, and, I don’t know, timber—would be better inflation hedges. After all, if prices go up, the prices on the raw goods we need to make things should go up, too. The problem, of course, is that a ton of things, in addition to inflation expectations, influence commodities prices. Let’s take oil for example. This chart is from Inflation Data:

You’ll notice that the 1979 high for oil (in 2010 dollars) wasn’t topped again until 2008. Of course, inflation didn’t go down over that long time period. Quite the contrary. There were just a few hurricanes and a couple major oil crises that jostled the price of oil around, even as inflation made its inevitable climb upward.

Other commodities face similar circumstances. But even if they didn’t, keep in mind: Commodities reflect inflation expectations. So if you’re thinking about buying some oil ETFs right now in expectation of high inflation, you’re already late to the game. Even if inflation does rise rapidly, if it doesn’t keep up with the lofty inflation expectations the market has set for it, commodity prices could still drop.

And I’m tempted to skip gold, but what the hell…

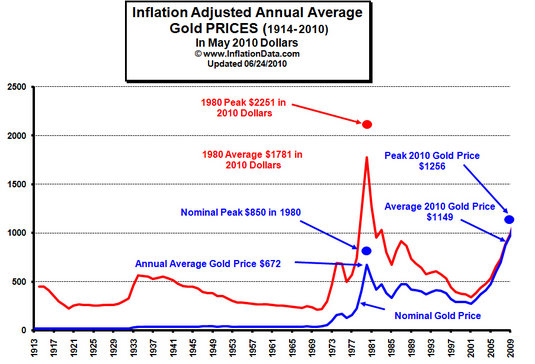

Not that some reasonable people aren’t making arguments for gold investments. It’s just I feel like it’s unfair to keep beating up on this one. One last chart, also from Inflation Data:

Similar to the oil chart, you’ll see that even though the price of gold, currently at about $1,200 an ounce, has surged this year, it’s still nowhere close to the $2,251 peak it reached in 1980 in today’s dollars.

If anything, gold is a crisis hedge. If the U.S. government collapsed and the world collectively decided to revert to a medieval trading system in which precious metals of limited industrial use became the currency du jour, then gold might be a good investment. When I write about this, a common counterattack is to say that the dollar itself only has value by fiat (i.e., because the U.S. government says it does).

They’re absolutely correct, but that’s the whole point. The dollar has the fiat, both from the government and (implicitly) from investors who flock to it in the face of danger. Gold has an implicit fiat from a limited number of investors and practically no governments. And…oh forget it. If you’re going to buy gold, at least don’t listen to Glenn Beck and buy coins through Goldline.

TIPS: An imperfect option, but the closest to perfect you’ll get.

Treasury Inflation-Protected Securities are Treasury bonds created by the U.S. government whose principal also adjusts with the Consumer Price Index. As many people point out, CPI is an imperfect measure of inflation. Even putting aside the specious, government-lies-about-everything arguments for a moment, there is no possible way that what you spend money on will track CPI exactly. If you, for example, have to spend a lot of money on healthcare, whose cost is rising several times faster than CPI, your personal inflation rate will be higher.

However, TIPS, and their less-mentioned cousins, I Savings Bonds, will at least track inflation loosely, without the wild, speculative swings that stocks, commodities, and gold fall subject to.

Right now, a 10-year TIPS bond yields 1.09% after that periodic inflation adjustment. Given that regular Treasury bonds of that length yield less than 3% right now, that implies investors think inflation over the next decade will actually be extremely low.

And best of all, TIPS can easily be bought straight from the U.S. government. One word of warning though, if you buy them this way, make sure you hold them until they mature. Selling individual bonds is expensive, and bond prices will move around as interest rates move. If you think you’ll sell before the maturity date, try a TIPS mutual fund or ETF instead, though they won’t track inflation as exactly.

Anyway, I’m sure there are good arguments in favor of some of the traditional inflation “hedges” investors have used over the years, and throwing a few charts out there does not a Ph.D. dissertation make. How would you challenge some of the arguments I’ve laid out here?

{ 1118 comments… read them below or add one }

← Previous Comments

Эта статья является настоящим источником вдохновения и мотивации. Она не только предоставляет информацию, но и стимулирует к дальнейшему изучению темы. Большое спасибо автору за его старания в создании такого мотивирующего контента!

Автор статьи предоставляет информацию, подкрепленную исследованиями и доказательствами, без выражения личных предпочтений. Это сообщение отправлено с сайта https://ru.gototop.ee/

Мне понравилась организация статьи, которая позволяет легко следовать за рассуждениями автора.

Эта статья является настоящим сокровищем информации. Я был приятно удивлен ее глубиной и разнообразием подходов к рассматриваемой теме. Спасибо автору за такой тщательный анализ и интересные факты!

Great info. Lucky me I came across your website by chance (stumbleupon). I’ve book marked it for later!

You have remarked very interesting details! ps nice site.

I got good info from your blog

What i don’t understood is in reality how you’re no longer really a lot more well-favored than you might be now. You’re very intelligent. You recognize thus considerably in terms of this subject, made me in my opinion imagine it from a lot of numerous angles. Its like women and men are not interested unless it is one thing to accomplish with Girl gaga! Your personal stuffs nice. All the time take care of it up!

I really like it whenever people come together and share thoughts. Great site, stick with it!

I dugg some of you post as I cogitated they were extremely helpful very helpful

This domain violates guidelines and needs to be flagged.

Мне понравился объективный подход автора, который не пытается убедить читателя в своей точке зрения.

Exceptional post however , I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit more. Appreciate it!

http://power-p.ru/ehkologija

Читателям предоставляется возможность самостоятельно изучить представленные факты и сделать информированный вывод.

Эта статья – источник ценной информации! Я оцениваю глубину исследования и разнообразие рассматриваемых аспектов. Она действительно расширила мои знания и помогла мне лучше понять тему. Большое спасибо автору за такую качественную работу!

Hello, I log on to your blogs on a regular basis. Your story-telling style is witty, keep it up!

Hi there! This is my 1st comment here so I just wanted to give a quick shout out and say I truly enjoy reading through your blog posts. Can you recommend any other blogs/websites/forums that go over the same subjects? Many thanks!

We stumbled over here coming from a different website and thought I might as well check things out. I like what I see so now i am following you. Look forward to finding out about your web page repeatedly.

Hey there would you mind letting me know which hosting company you’re utilizing? I’ve loaded your blog in 3 completely different browsers and I must say this blog loads a lot faster then most. Can you suggest a good hosting provider at a fair price? Thanks, I appreciate it!

Очень интересная статья! Я был поражен ее актуальностью и глубиной исследования. Автор сумел объединить различные точки зрения и представить полную картину темы. Браво за такой информативный материал!

Excellent goods from you, man. I have consider your stuff previous to and you’re just too fantastic. I actually like what you’ve acquired right here, really like what you are saying and the way through which you are saying it. You’re making it entertaining and you still take care of to stay it smart. I can not wait to learn far more from you. That is actually a great website.

I think the admin of this web site is really working hard in favor of his web site, because here every material is quality based stuff.

Does your blog have a contact page? I’m having a tough time locating it but, I’d like to shoot you an email. I’ve got some suggestions for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it grow over time.

obviously like your web site however you have to check the spelling on quite a few of your posts. Several of them are rife with spelling issues and I find it very troublesome to inform the truth nevertheless I?¦ll certainly come again again.

Only a smiling visitor here to share the love (:, btw outstanding pattern.

Hi! I’ve been following your weblog for a long time now and finally got the courage to go ahead and give you a shout out from Lubbock Tx! Just wanted to say keep up the fantastic job!

Undeniably consider that which you stated. Your favourite justification seemed to be on the internet the simplest thing to have in mind of. I say to you, I certainly get annoyed at the same time as folks think about issues that they plainly don’t understand about. You managed to hit the nail upon the highest and also outlined out the entire thing without having side-effects , other people could take a signal. Will likely be back to get more. Thanks

F*ckin’ awesome things here. I’m very satisfied to look your post. Thanks so much and i’m looking forward to touch you. Will you kindly drop me a e-mail?

so much great information on here, : D.

Just wish to say your article is as astonishing. The clearness in your post is simply great and i can assume you are an expert on this subject. Well with your permission let me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please carry on the rewarding work.

Статья помогла мне получить более полное представление о проблеме, которая рассматривается.

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My blog site is in the exact same area of interest as yours and my users would definitely benefit from a lot of the information you present here. Please let me know if this ok with you. Thanks!

Hello there! I could have sworn I’ve been to this site before but after browsing through many of the posts I realized it’s new to me. Anyhow, I’m certainly happy I came across it and I’ll be bookmarking it and checking back often!

Excellent post. I was checking continuously this blog and I am impressed! Extremely useful information specially the last part I care for such information much. I was seeking this particular info for a very long time. Thank you and best of luck.|

I care for such information much. I was seeking this particular info for a very long time. Thank you and best of luck.|

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something enlightening to read?

Hello very cool web site!! Man .. Excellent .. Superb .. I’ll bookmark your website and take the feeds also? I am glad to find a lot of useful info here in the post, we’d like work out extra strategies on this regard, thanks for sharing. . . . . .

I used to be very happy to seek out this web-site.I wanted to thanks on your time for this excellent read!! I positively having fun with each little bit of it and I have you bookmarked to take a look at new stuff you weblog post.

What i do not realize is actually how you are not actually much more well-liked than you may be right now. You are so intelligent. You realize therefore significantly relating to this subject, produced me personally consider it from numerous varied angles. Its like women and men aren’t fascinated unless it is one thing to accomplish with Lady gaga! Your own stuffs excellent. Always maintain it up!

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several emails with the same comment. Is there any way you can remove people from that service? Thanks!

I have learned a number of important things by means of your post. I’d also like to express that there might be situation in which you will have a loan and don’t need a cosigner such as a Federal Student Support Loan. But if you are getting a borrowing arrangement through a conventional bank or investment company then you need to be made ready to have a co-signer ready to help you. The lenders will probably base their own decision over a few issues but the largest will be your credit ratings. There are some loan merchants that will also look at your work history and make up your mind based on that but in many cases it will hinge on your credit score.

One thing I would really like to discuss is that weightloss system fast is possible by the appropriate diet and exercise. People’s size not merely affects the look, but also the overall quality of life. Self-esteem, despression symptoms, health risks, and physical ability are influenced in fat gain. It is possible to make everything right and at the same time having a gain. If this happens, a condition may be the culprit. While a lot food instead of enough exercising are usually guilty, common medical ailments and widespread prescriptions can greatly enhance size. Thanks a bunch for your post in this article.

There is apparently a bundle to identify about this. I consider you made various nice points in features also.

Nice post. This wasn’t what I was searching for but I still liked reading it.

I am continually searching online for articles that can aid me. Thank you!

Would you be excited by exchanging links?

Keep working ,impressive job!

After study a few of the weblog posts in your web site now, and I truly like your approach of blogging. I bookmarked it to my bookmark website checklist and will be checking again soon. Pls take a look at my website as effectively and let me know what you think.

Generally I don’t learn post on blogs, but I would like to say that this write-up very pressured me to check out and do it! Your writing taste has been surprised me. Thanks, very nice article.

Nice blog right here! Also your website so much up very fast! What web host are you the usage of? Can I am getting your affiliate link in your host? I want my site loaded up as quickly as yours lol

← Previous Comments