Not that any of them are all that great.

The hot air balloon above is inflating. Get it? Get it?! Sorry. I’m tired.

There are only so many ways our government can eliminate the deficit and eventually pay off its gigantic debt. The least painful—and the one federal officials were desperately hoping for when they enacted the stimulus—is to grow the economy. With the economy growing, they get more tax revenues without having to change any laws.

Two, less optimum solutions are to raise taxes or spend less. Both of those make voters angry. Spending cuts sound good until you realize it means your kid’s classroom goes from 25 students to 30 students. Raising taxes never plays well, even when you purport to target the highest-income households.

That leaves inflation. No politician has to vote for it. It’s hard for rivals to point to interest rates and say, “Congressman Smith did this!” Inflation is simply the easiest way to pay off the deficit without alienating your constituents. Yeah, it’s weak, but when push comes to shove, you’ve got to believe inflation is going to rise before Congress successfully balances the budget.

So where does that leave you? And what can you do to make sure a devaluing dollar doesn’t decimate your portfolio? And for that matter, how can you stop Pop from excessive alliteration?

The myth of stocks as inflation-fighter.

One of the most common arguments in favor of investing in stocks is that they keep your portfolio from being silently eaten away by inflation. For your retirement money to keep its earning power, the yarn goes, you need assets whose returns will outpace inflation. Stocks are one, good answer.

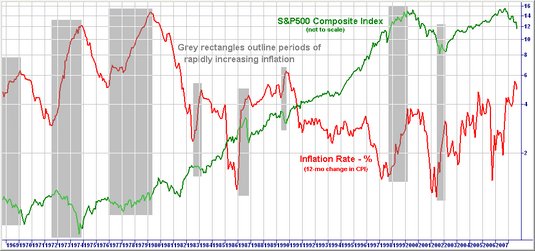

Except they aren’t. In fact, stocks tend to do terrible when inflation is high. Take a look at this chart from Martin Capital Advisors.

In times of rapid inflation (the gray boxes), the S&P 500 (the green line) tended to drop, sometimes by a huge amount.

The point is, while stocks will probably outpace inflation over the long-term, holding stocks as a short-term panacea to what you might think is a coming bout of major inflation doesn’t make sense. Indeed, it seems misleading that the two issues ever got combined. Yes, inflation is an enemy to your portfolio. Yes, stocks—even at a conservative 5% growth rate—outpace the average inflation rate of about 3% over the longterm. But the two aren’t built to counteract each other.

What about commodities?

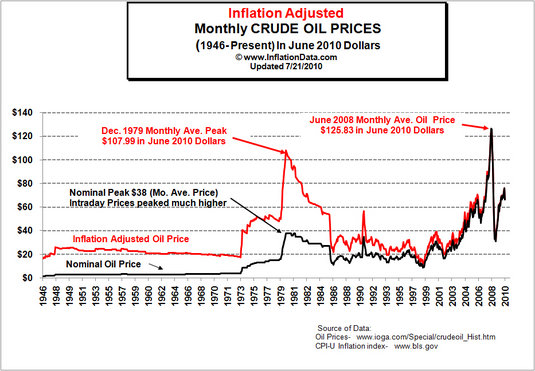

It would seem that commodities—such as oil, natural gas, and, I don’t know, timber—would be better inflation hedges. After all, if prices go up, the prices on the raw goods we need to make things should go up, too. The problem, of course, is that a ton of things, in addition to inflation expectations, influence commodities prices. Let’s take oil for example. This chart is from Inflation Data:

You’ll notice that the 1979 high for oil (in 2010 dollars) wasn’t topped again until 2008. Of course, inflation didn’t go down over that long time period. Quite the contrary. There were just a few hurricanes and a couple major oil crises that jostled the price of oil around, even as inflation made its inevitable climb upward.

Other commodities face similar circumstances. But even if they didn’t, keep in mind: Commodities reflect inflation expectations. So if you’re thinking about buying some oil ETFs right now in expectation of high inflation, you’re already late to the game. Even if inflation does rise rapidly, if it doesn’t keep up with the lofty inflation expectations the market has set for it, commodity prices could still drop.

And I’m tempted to skip gold, but what the hell…

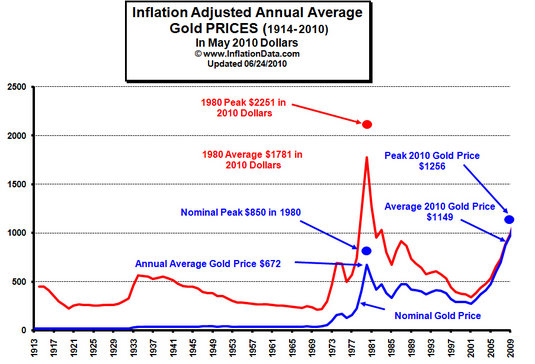

Not that some reasonable people aren’t making arguments for gold investments. It’s just I feel like it’s unfair to keep beating up on this one. One last chart, also from Inflation Data:

Similar to the oil chart, you’ll see that even though the price of gold, currently at about $1,200 an ounce, has surged this year, it’s still nowhere close to the $2,251 peak it reached in 1980 in today’s dollars.

If anything, gold is a crisis hedge. If the U.S. government collapsed and the world collectively decided to revert to a medieval trading system in which precious metals of limited industrial use became the currency du jour, then gold might be a good investment. When I write about this, a common counterattack is to say that the dollar itself only has value by fiat (i.e., because the U.S. government says it does).

They’re absolutely correct, but that’s the whole point. The dollar has the fiat, both from the government and (implicitly) from investors who flock to it in the face of danger. Gold has an implicit fiat from a limited number of investors and practically no governments. And…oh forget it. If you’re going to buy gold, at least don’t listen to Glenn Beck and buy coins through Goldline.

TIPS: An imperfect option, but the closest to perfect you’ll get.

Treasury Inflation-Protected Securities are Treasury bonds created by the U.S. government whose principal also adjusts with the Consumer Price Index. As many people point out, CPI is an imperfect measure of inflation. Even putting aside the specious, government-lies-about-everything arguments for a moment, there is no possible way that what you spend money on will track CPI exactly. If you, for example, have to spend a lot of money on healthcare, whose cost is rising several times faster than CPI, your personal inflation rate will be higher.

However, TIPS, and their less-mentioned cousins, I Savings Bonds, will at least track inflation loosely, without the wild, speculative swings that stocks, commodities, and gold fall subject to.

Right now, a 10-year TIPS bond yields 1.09% after that periodic inflation adjustment. Given that regular Treasury bonds of that length yield less than 3% right now, that implies investors think inflation over the next decade will actually be extremely low.

And best of all, TIPS can easily be bought straight from the U.S. government. One word of warning though, if you buy them this way, make sure you hold them until they mature. Selling individual bonds is expensive, and bond prices will move around as interest rates move. If you think you’ll sell before the maturity date, try a TIPS mutual fund or ETF instead, though they won’t track inflation as exactly.

Anyway, I’m sure there are good arguments in favor of some of the traditional inflation “hedges” investors have used over the years, and throwing a few charts out there does not a Ph.D. dissertation make. How would you challenge some of the arguments I’ve laid out here?

{ 1118 comments… read them below or add one }

← Previous Comments

Статья хорошо структурирована, что облегчает чтение и понимание.

Автор предлагает анализ разных подходов к решению проблемы и их возможных последствий.

Everything is very open with a very clear description of the challenges. It was definitely informative. Your site is very useful. Many thanks for sharing!

Hello, i think that i noticed you visited my blog thus i got here to go back the want?.I am attempting to find things to enhance my website!I assume its adequate to make use of a few of your concepts!!

It’s actually a nice and helpful piece of info. I am happy that you shared this helpful info with us. Please stay us up to date like this. Thank you for sharing.

Автор предлагает логические выводы на основе представленных фактов и аргументов.

Я прочитал эту статью с огромным интересом! Автор умело объединил факты, статистику и персональные истории, что делает ее настоящей находкой. Я получил много новых знаний и вдохновения. Браво!

Я не могу не отметить качество исследования, представленного в этой статье. Она обогатила мои знания и вдохновила меня на дальнейшее изучение темы. Благодарю автора за его ценный вклад!

Have you ever considered publishing an e-book or guest authoring on other websites? I have a blog centered on the same information you discuss and would really like to have you share some stories/information. I know my readers would enjoy your work. If you’re even remotely interested, feel free to send me an e-mail.

Статья позволяет получить общую картину по данной теме.

Автор старается быть объективным и предоставляет достаточно информации для осмысления и дальнейшего обсуждения.

Автор не старается убедить читателей в определенном мнении, а предоставляет информацию для самостоятельной оценки.

Автор предоставляет дополнительные ресурсы для тех, кто хочет углубиться в изучение темы.

Wow, awesome blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your web site is great, let alone the content!

Oh my goodness! Impressive article dude! Many thanks, However I am having issues with your RSS. I don’t understand why I can’t join it. Is there anybody having identical RSS issues? Anybody who knows the solution will you kindly respond? Thanks!!

Я нашел в статье несколько полезных советов.

Я оцениваю широту охвата темы в статье.

Heya i’m for the first time here. I found this board and I in finding It really helpful & it helped me out a lot. I hope to present something again and aid others such as you aided me.

Интересная статья, в которой представлены факты и анализ ситуации без явной предвзятости.

Hey there! This is my first comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading through your articles. Can you recommend any other blogs/websites/forums that go over the same topics? Many thanks!

Я благодарен автору этой статьи за его способность представить сложные концепции в доступной форме. Он использовал ясный и простой язык, что помогло мне легко усвоить материал. Большое спасибо за такое понятное изложение!

Hi are using Wordpress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any coding expertise to make your own blog? Any help would be really appreciated!

Автор старается подойти к теме без предубеждений.

Right away I am going to do my breakfast, after having my breakfast coming over again to read more news.

Автор статьи предоставляет информацию, подкрепленную надежными источниками, что делает ее достоверной и нейтральной.

Приятно видеть объективный подход и анализ проблемы без сильного влияния субъективных факторов.

Excellent way of explaining, and nice paragraph to take information regarding my presentation subject, which i am going to deliver in school.

When someone writes an article he/she maintains the plan of a user in his/her brain that how a user can know it. Therefore that’s why this piece of writing is amazing. Thanks!

Я хотел бы подчеркнуть четкость и последовательность изложения в этой статье. Автор сумел объединить информацию в понятный и логичный рассказ, что помогло мне лучше усвоить материал. Очень ценная статья!

Я не могу не отметить стиль и ясность изложения в этой статье. Автор использовал простой и понятный язык, что помогло мне легко усвоить материал. Огромное спасибо за такой доступный подход!

Статья помогла мне лучше понять контекст и значение проблемы в современном обществе.

Я оцениваю широту охвата темы в статье.

Статья помогла мне лучше понять сложные концепции, связанные с темой.

Эта статья является настоящим сокровищем информации. Я был приятно удивлен ее глубиной и разнообразием подходов к рассматриваемой теме. Спасибо автору за такой тщательный анализ и интересные факты!

Я хотел бы выразить свою благодарность автору этой статьи за исчерпывающую информацию, которую он предоставил. Я нашел ответы на многие свои вопросы и получил новые знания. Это действительно ценный ресурс!

Статья помогла мне лучше понять сложную тему.

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on a number of websites for about a year and am anxious about switching to another platform. I have heard excellent things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any kind of help would be greatly appreciated!

Конечно, вот ещё несколько положительных комментариев на статью. Это сообщение отправлено с сайта https://ru.gototop.ee/

Это способствует более глубокому пониманию и анализу представленных фактов.

Hmm it looks like your site ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to everything. Do you have any helpful hints for first-time blog writers? I’d definitely appreciate it.

Я просто не могу не поделиться своим восхищением этой статьей! Она является источником ценных знаний, представленных с таким ясным и простым языком. Спасибо автору за его умение сделать сложные вещи доступными!

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove people from that service? Appreciate it!

Автор старается представить информацию нейтрально и всеобъемлюще.

I was suggested this blog by my cousin. I’m no longer certain whether this put up is written by way of him as no one else know such specified about my difficulty. You’re amazing! Thank you!

Автор умело структурирует информацию, что помогает сохранить интерес читателя на протяжении всей статьи.

Автор статьи представляет информацию в четкой и нейтральной форме, основываясь на надежных источниках.

Это помогает читателям получить полное представление о сложности и многогранности обсуждаемой темы.

Статья помогла мне получить более полное представление о проблеме, которая рассматривается.

What i don’t understood is actually how you are no longer really much more well-appreciated than you may be now. You’re so intelligent. You understand therefore considerably in relation to this topic, produced me individually consider it from numerous various angles. Its like women and men aren’t interested until it’s something to accomplish with Lady gaga! Your personal stuffs great. All the time handle it up!

Читателям предоставляется возможность самостоятельно исследовать представленные факты и принять собственное мнение.

← Previous Comments